Market Watch. September 2020 II

Market Watch. September 2020 II

Macro Update: Global macro indicators show a robust worldwide recovery

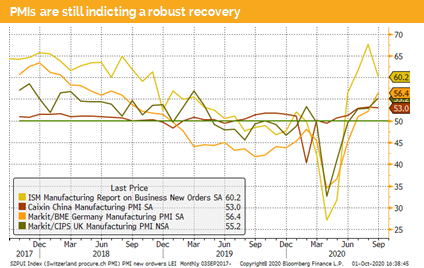

The latest PMI data in China are not only stronger than expected but also clearly indicate that the economic recovery gains momentum.

The latest consumer data in the US were surprisingly strong. Although those tax subsidies were stopped in August. Therefore the largest two economies are both continuing to show better growth than economist have expected.

The latest PMI data confirm a continuation of robust economic growth for the major areas, The aggregated JPM global PMI confirms this observation, as the indicator has increased in September from 51.8 to 52.3. Basically, we see a slowdown of growth, but we continue to expect slightly better growth over the next 6-9 months as the PMIs stayed clearly in the growth area.

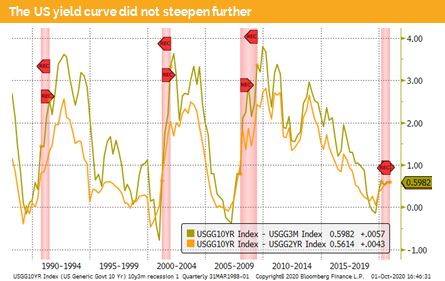

The US yield curve spreads show a similar picture. I.e. there was no further steepening during September, but neither there was a flattening of the curve. This indicates that the bond market prices are in a process of the actual growth without any significant de- or acceleration. The whole US yield curve has shifted down, which is a result of the latest Fed announcement to keep rates at zero for a much longer time than ever expected. With the bond buying program they also implicitly control the yield curve.

Similar picture worldwide: Swiss business cycle indicator (KOF), the Japanese Tankan report, the German IFO, Korea’s September export statistic and the Indian PMI data all confirm a robust global recovery of economic growth.

To come out of the US recession market participants expect further fiscal stimulus. The US stock market is pricing in the fact that such a stimulus package will be implemented before the US election. Due to the weak Mr. Trumps’ speech during the first US presidential TV debate, he and his party are now eager to agree on a fiscal package to improve his reelection chances.

Over the next months we still expect a disinflationary environment. But mid-term after the ECB follows the Fed, market participants expect that both let inflation overshoot. Therefore, policy rates will stay low even after a pickup of inflation and economic activity. As consequences there will be longer negative real yields and more outstanding government debt. This aka financial repression will dilute the public debt by transferring wealth from creditors to debtors. Implicitly both central banks have indicated that they are willing to finance the public debt through money printing followed by bond buying programs, which is a monetization of public debt.

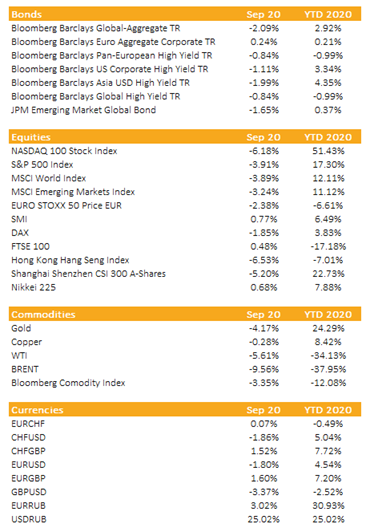

Market Overview: Currencies, Commodities, Equity & Bond Indices

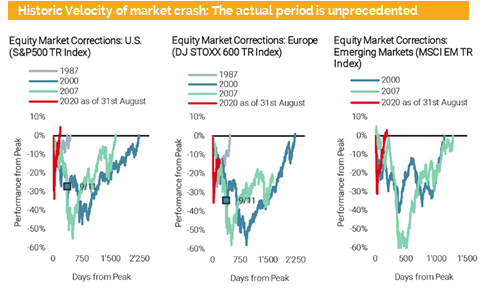

The actual recession and equity market correction are unprecedented. In less than 6 months the S&P 500 and Global Emerging Markets have not only corrected by more than 30% but they have also regained all their losses.

Differently, but not surprisingly, Europe has lost more and is still around 10% under water. We do not see a catch up any time soon. The global recovery is led by Asia and the US, leaving Europe far behind.

We therefore keep European Equites as our least preferred area to invest. This holds also true for the UK, where the FTSE 100 still is around 20% in the red.

Swiss Equities, measured by the SMI (including dividends), are slightly below zero due to the heavy weights of Nestlé and the two pharma companies.

Forward looking we believe there is more upside for global equites. Most likely the main drivers will again be FANG+ stocks. We do as well see that the clean energy sector might further advance although YTD of the sector measured by the Wilder Hill Clean Energy index has risen by more than 75% and might correct mid-term before a next leg up.

Investment Outlook: US Earnings might surprise and push market further up

Liquidity

The CHF has depreciated against the USD and was range bound against the EUR. The later was steered by the Swiss National bank.

The EUR has strengthened against the USD. The market is now extremely long in EUR, which might mean revert. The strong surge was driven mainly by politics (rescue fund, fiscal stimulus) and positioning.

The USD started to fade over the last trading days. The short-term positioning is still long USD, which seems to be unwidened now. A 2nd factor is better than expected macro data for the global economy, which reduces the need to park money in the save haven currency.

Equities

During September we have seen a typical weak market in both equities and corporate bonds. However, we stressed several times before that the market needs to mean revert as it went up to far in a too short period.

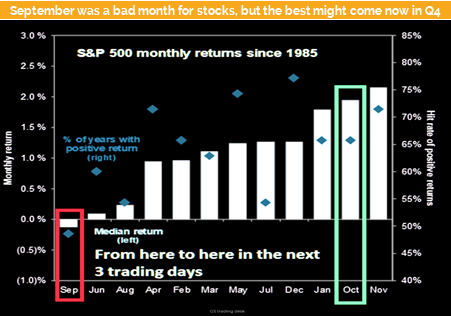

We continue to expect higher equity markets in Q4, but due to the uncertain outcome of the US election we might see not only more volatility but also slightly negative US equity markets in October. Since 1928 in the US election years the S&P 500 did on average lose slightly just before the new president was confirmed. However in the following November the index has been rising on average by 3.9%, which is well above the average of 2% for the whole period since 1928.

Fixed Income

For the last three weeks emerging market corporate bonds have consolidated. The main negative contributor was spread widening. US high yields came under pressure due to the fear of a global economic slowdown and the 2nd pandemic wave. That latest US consumer confidence figures are therefore in a stark contrast to these fears.

We believe that the losses of corporate bonds were mainly driven by the losses of global equities due to various reasons. Nevertheless, the pullback in equities was overdue and that might just explain most of both equity and corporate bond market movements over the last weeks.

Alternative Investments

Gold: The spot gold price has retested the summer lows. The price went down to its 100-day average and like the S&P 500 did rebound from that resistance level. Beside technical factors the correction was driven by a stronger USD, which should mid-term weaken again, and therefore we continue to expect a higher gold price over the coming months.

REITs: European residential REITs corrected together with the equity market. Now we expect them to recover together with the equity market as well.

Copper has sold off due to the fear of shrinking global industrial production. Since some days we have seen a mean reversion due to better industrial PMI data from China, the US and other countries. Afterall, it was followed by the next drop due to the disagreement of a 5th US fiscal package.

Investments covered:

Levi Strauss 5% 2025

Vivo Energy 5.125% 2027

Perenti Global 6.5% 2025

Logan Group 5.75% 2025

Shimao Group 6.126% 2024

Cisco Systems

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate