To correct or not to correct, that is the question

To correct or not to correct, that is the question

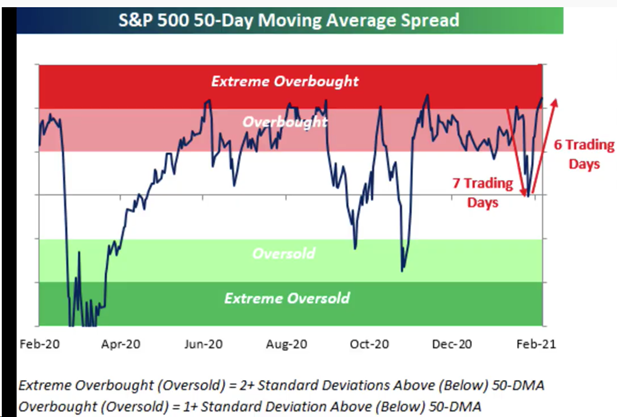

Equities have pulled back in January around 5% during 7 trading days only to be followed by a stronger rise in February to new record levels. Buying the dip is still the winning strategy. However, we are back to the extremely overbought area. Same situation is present in the oil future market – both WTI futures and Brent trade in the overbought area. Both markets are priced in the re-opening economy.

In global government bond markets we see significantly higher yields and lower bond prices as these markets are as well pricing in a recovery and higher expected inflation. Fed chair Powel confirmed that they will not raise rates until we see inflation above 2% and full US employment, what has to put more pressure on US treasury prices.

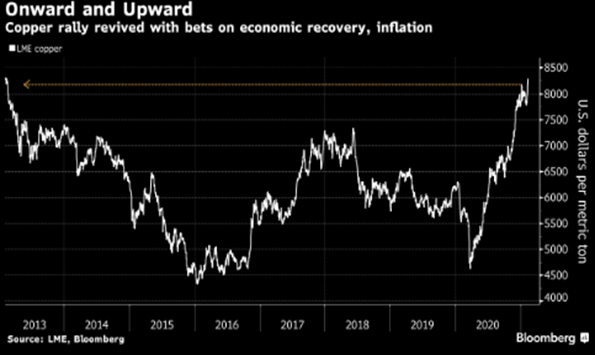

Meanwhile soft economic indicators continue to indicate an acceleration of growth during 2021. Dr. cooper has risen to a new year high after a minor setback.

Fig. 1: S&P 500 back in the overbought area

Fig. 2: WTI and Brent futures prices are both in the overbought territory

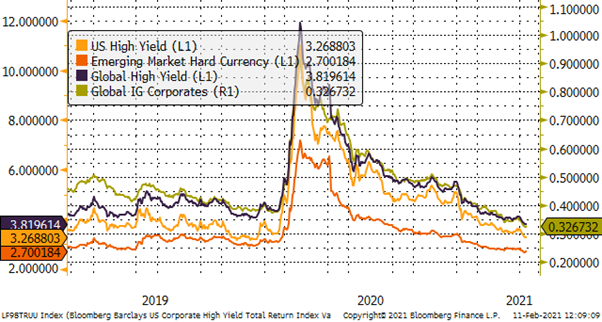

Meanwhile we see a further spread tightening in the corporate bond markets.

Fig. 3: Corporate bonds’ spreads have further tightened

Fig. 4: 10-year Treasury yields have risen above 1.1%

Fig. 5: Dr. Cooper point to an acceleration of growth in 2021

Fig. 6: The total amount of negative yielding debt has significantly decreased in 2021

The positive growth outlook is well visible in the total amount of negative yielding debt. From USD 18.4 trillion we went down to USD 15.8 trillion. Goldman Sachs has again increased their US GDP growth forecast to 6.8% for 2021, which would be around 4% above the potential growth rate for the US. This view is supported by the expected next US fiscal stimulus package. of max. USD 1.9 trillion. Recent signals from the senate indicate that we get closer to the proposed USD 1.9 trillion, which took the market by surprise, as initially a package bellow USD 1.0 trillion was expected to pass through the parliaments.

The expected equity sector rotation has happened: for instance, the Russel 2000 has significantly outperformed the Nasdaq and the broad US market. Needless to say, that US small caps also trade at frothy prices. Asian equity markets have risen around 15% since the beginning of the year. A pullback is overdue, but it can well be that this liquidity driven rally will further go up before we correct. Over that last trading sessions any weakness was so far used to buy the dip. Mid-term we believe that the recovery will support corporate bond and equity markets, but the technical situation will normalize over the coming weeks.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate