Make or break: US equity markets hover around all-time highs

Make or break: US equity markets hover around all-time highs

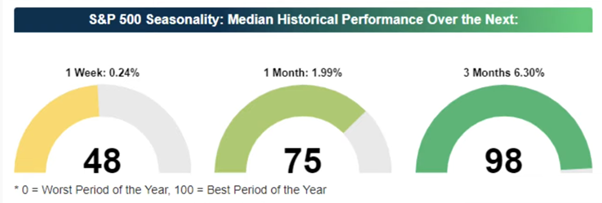

US equity markets have consolidate this week. Based on historical return patterns this is quite normal (Fiq. 3). The key question is will we get a pullback before a next leg up? Or will finally the pullback materialize? Seasonality and bull market history speak rather against a correction before Q1, but negative news flow can change market sentiment within minutes. Yesterday’s announcement that Pfizer BionTech will not be able to produce the promised number of doses this year and that there are logistic challenges to distribute the vaccine made the market sentiment turning negative. Both however, should not have been a big surprise, but as there is so much complacency in the market it needs very little to turn markets around.

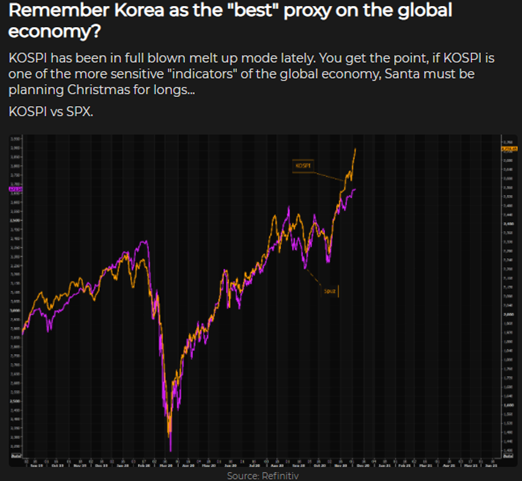

South Koreans export and PMI data are both good leading indicators for the further development of the global economy. The Korean stock market seems to follow these leading indicators, which rise hope that global equity markets will follow the Korean market.

Fig. 1: Will the S&P 500 follow the KOSPI?

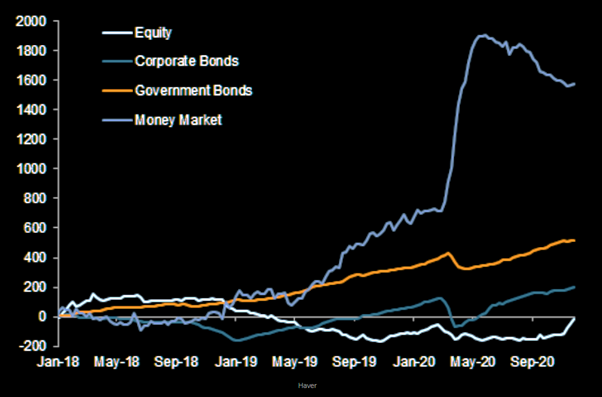

Based on this we continue to believe that over the coming months US and global equity markets should continue their way up. Net Inflow into global equites over the last 3 years is flat and not positive. Seasonality speaks as well for higher markets.

Fig. 2: Inflow into equites over the last 3 years now finally flat, but money market up too

Fig. 3: Median performance after Thanksgiving: up 2% and 6% after three months

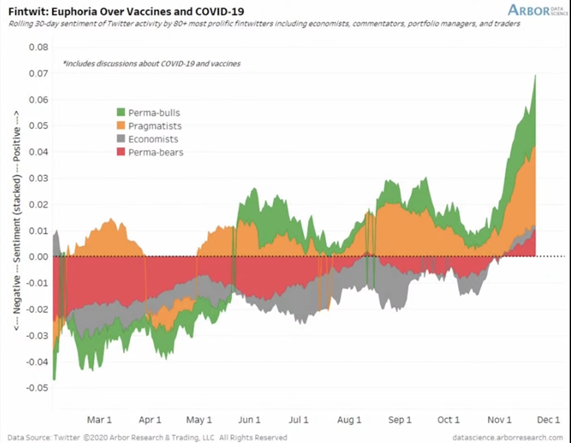

There are however no bears around which is scaring. But such exuberance phases can last for some weeks before it normalizes. We therefore would not sell equites. We recommend however to rebalance and add to laggards by financing it by selling some winners of 2020. This rather cautious short-term assessment gets supported by the fact that short-sellers and permabears have turned bullish, a good indicator to get cautious.

Fig. 4: There are no bears left!

Over the last trading days gold successfully tested its 200-day average. After a short overshooting we are now trading at around USD 1’840 per ounce and might soon test the next resistance zone at around USD 1’880.

Fig. 5: Gold has regained its 200-day average and might try to overcome 1880 level

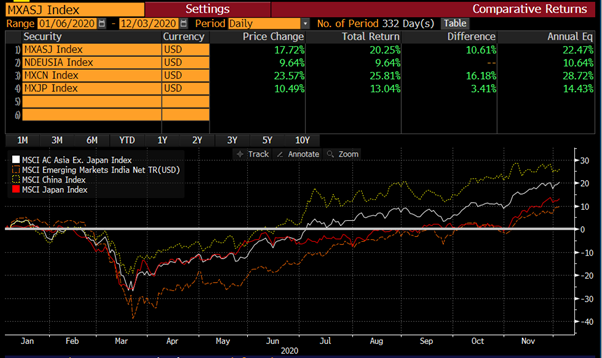

Fig. 6: Indian equites might catch up with other Asian Markets

The latest news about the Indian economy is that the country is in a recession. However like the Brazilian equity market the Indian market has risen sharply recently. We continue to prefer Asian equities over US equities and do underweight Europe. Within Asia we might have a short period where Indian equities catch up with the rest of the region.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate