Fireworks after the announcement that the COVID-19 vaccine works in 90% of the cases

Irrational exuberance is what comes to my mind repassing yesterday’s strong market rally in corporate bonds and equities. On Monday until around 12:15 CET markets were across the globe up around 2%, while suddenly we have seen a spike up in European market prices and in US futures.

Pfizer and BionTech have announced that their vaccine prevents COVID-19 in 90% of all tested cases. What followed was a sector rotation out of FANG+ stocks into cyclicals, small caps and value stocks. Cruise companies were suddenly up 20%, luxury goods rallied in similar ways. Airlines and airports have as well gone up sharply. Is this rational? The answer is a kind of obvious. In the best case the vaccine gets in the next 2 weeks an approval from the US authority and the companies might produce until year end 50 million doses. In the best-case next year, another 1-1.5 billion doses, but to get the virus under control we need to have 80% of the world population been vaccinated and this is simple impossible based on just one approved vaccine. Therefore, the virus will be unfortunately still dictating our life in H2 2021! But we learned one thing, the market looks through the actual economic downturn and although the spike was too big, we see light at the end of the tunnel and further upside.

Fig. 1: S&P 500 futures are now trading in uncharted territory

We believe that this is the beginning of a rally, but we also would say after yesterdays move a pullback before a possible next leg up must be expected.

The president elect meanwhile has started to work on a COVID-19 expert task force. Trump on the other hand tries to go to court to get in some states a recount and tries to prove that there was a fraud. The only thing he might prove is that in rare cases dead people got an envelop to vote, like it happened with the subsidy which was distributed in spring. But there is no evidence that there were any irregularities during the counting process. We expect that in January Biden will get started as planned. We might not get a smooth transition or a fiscal package before that. It is still open if the Senate will stay in republicans’ hand. But overall, it looks like a divided situation, where the president does not have the majority in both parliaments. This however is good news for tech stocks and the economy in general. Also, taxes cannot be raised significantly over the coming two years, that is why markets globally were up on Monday morning.

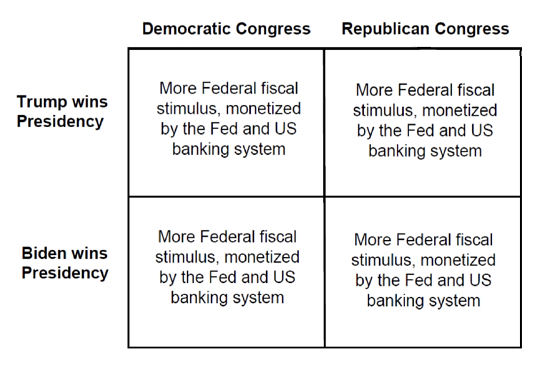

Market participants believe that it does not matter who will lead the congress, in both cases we will get more fiscal stimulus. Mid-term a democratic congress would however have some impact on the implementation of new taxes and green policy. Therefore, we believe divided parliaments and Biden is a better starting point for further market upsides.

Fig. 2: It does not matter who wins the congress

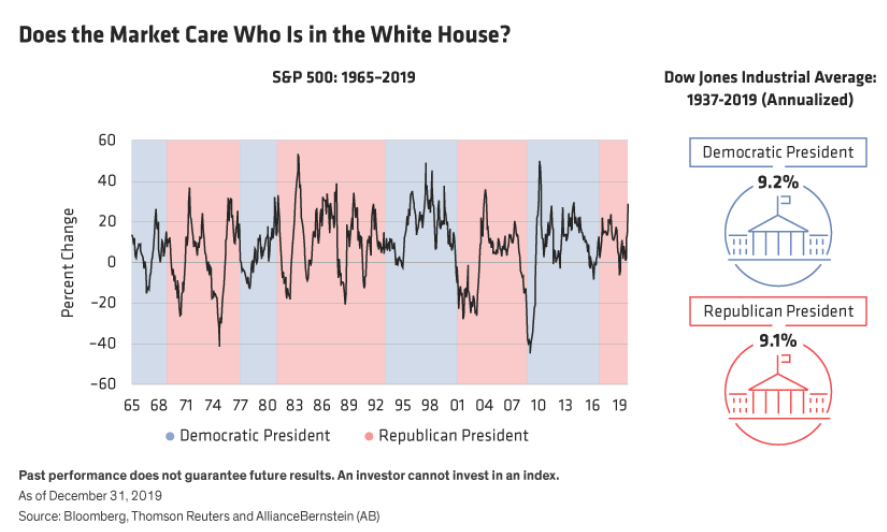

Fig. 3: History tells us markets go up independent of who is US president

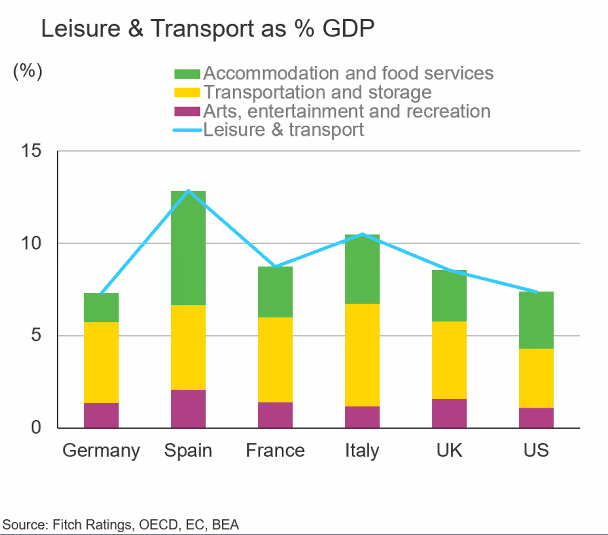

There are still two major risks in America, the 3rd Covid-19 wave could force more partial lockdowns. Will Trump be able to stay in charge? The latter looks unlikely. President Biden urges all Americans to wear masks and that this is no political statement but rather the only way forward until vaccines are available for most citizens, We do not expect a 2nd lockdown in the US. The US economy is doing well, because the partially closed service sector is not large enough to drag GDP down significantly.

Fig. 4: Locked-down sectors in percentage of total GDP in various countries

Fig. 5: US and Asian equites are significantly up while Europeans are still underwater

Therefore, the pain trade is still up. Short-term yesterday’s move must be digested before we have a good base for further gains. There is still a lot of money on the sideline which waits to be deployed, but YTD there was positive returns in treasuries, gold, US and Asian equities, which most market participants have missed. European banks on the other side were due to valuation overweight Europe. So far that has not worked out. Forward looking we expect a catch up of European equities but continue to prefer Asian and US equities.

Published: 10/11/20 by Blackfort CIO Dr. Andreas Bickel

Disclaimer

This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate