Fed Chair Powell pushed markets into the green

He did it again. Fed chair Powell has managed to calm down markets after his recent remarks at the IMF panel discussion. US equities markets closed all up and treasury yields decreased pushing prices up. We might see 10-year UST go down to 1.5% before we resee the recently reached year high of 1.77%. Such a bond rally would push equity markets further up. The distance of European and US equity indices to its 200-day average is around 10-15% up, which is high but last year we have seen an overshooting to around 30-35% before a minor pullback. Therefore, we reckon that this April might follow the seasonality pattern and we could see much higher prices.

Fig. 1: New records at US equity markets while volatility reaches a multi-month low

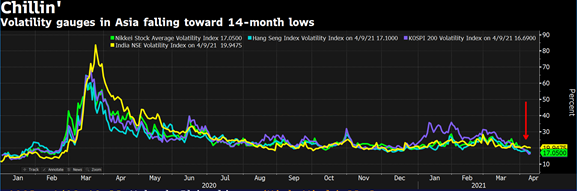

Fig. 2: Volatility in Asia decreases while equity markets consolidate

It is remarkable that across the globe we do see lower equity volatility indices as well. While in US and Europe markets are trading higher and most are even at record levels, in Asia we see an equity market consolidation with falling volatility, which is very unusual.

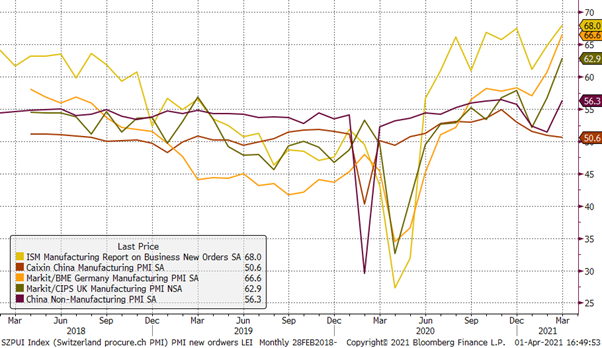

However, this bullish market sentiment is supported by very strong PMI data. Not only the industrial PMIs but also the service sector is anticipating a very strong economic recovery. Europe, where most countries are still in a lockdown and consider restricting further the public life (like in Germany) does show that the growth expectations due do the reopening are very high (based on PMI data or the German IFO). The IMF has just released its latest global growth outlook, which although stronger, is probably too conservative. Economists tend to underestimate the speed and power of economic recoveries in general and especially this one. The slowdown was artificially induced and therefore we cannot compare it with normal recessions, but we have unprecedented fiscal and monetary stimulus.

Fig. 3: PMI data surprised across the globe, only China Manufacturing was weaker

Speaking of USD bonds, we had an unprecedented year so far, global high yields are up around 2.4%, US high yields are up around 1.3%. At the same time US government bonds and US IG corporates lost more than 4% since the beginning of the year. High yield bonds behave like equites so far and there was even a spread tightening while equites have risen. Simultaneously safer IG corporates have seen rising yields and stable spreads.

Although we have seen rising government bond yields, the fact that amount of negative yielding debts is still at around 13 trillion USD is phenomenal and the real yields for 5- and 10-year US treasury bonds stay negative.

Fig. 4: US 10-year Treasury yields have risen more than 1.2% in one year

Fig. 5: US Real Government bond Yields (5Y and 10Y) are still negative

The recent decrease of nominal US yields has finally pushed gold up. After having tested lows below USD 1’700 per ounce twice we might have started a recovery rally. We have just reached the first resistance area at the 50-day average. Gold bulls expect that we soon get much higher prices to higher expected inflation data.

Today’s Chinese PPI and CPI data were both higher due to a statistical base effect (oil was falling sharply one year ago), which is expected to unfold as well in the next data points in the US and Europe.

Fig. 6: Gold has risen since the beginning of April and trades at its 50-day average

We have seen higher equity and corporate (non-IG) bond markets across the glove (except for Asia) and are reaching both levels where a consolidation might be healthy. However, the momentum is still positive, and we might first see higher prices before “sell in May and go away” might cross the news wire. However, most likely we are going to see after a possible consolidation or minor correction a climbing the wall of worry into the summer.

The roaring twenties scenario is still one which might unfold over the coming years. With a disruptive economy, a strong move towards digitalization in combination with never seen fiscal and monetary stimulus a melt up in financial markets before a sharp correction is the most likely scenario for the coming years.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate