Bi-Weekly. November 2020 I

Resilient Macro data in Asia and USA

The latest macro data show a significant improvement in Asia. China Services PMI was higher at 56.8 in October. Exports rose to 11.4% while imports moderated at 4.7%, largely on the back of a fall in imported commodities, mainly by copper and crude oil.

Similar picture is seen in the US, although the COVID-19 situation continues to worsen. Both ISM PMI indicators stayed in the acceleration areas. The Industrial PMI was very strong at almost 60.0. Also the service sector, which suffers from a partial lockdown, stayed above 55.0. Fitch calculated that only about 7% of total US GDP is affected by the actual lockdown in the leisure and transportation sectors.

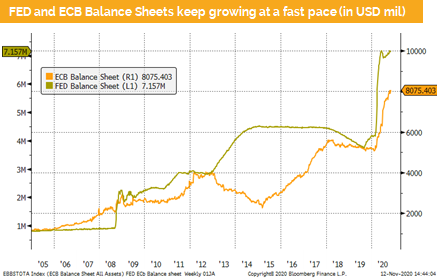

The outlook for the US has improved not only due to the availability of a vaccine, but also due to further stimulus. The Fed’s balance sheet is expected to grow sharply over the coming months due to QE4ever (quantitative easing forever).

The hope for a better global economic development lays on vaccines. The first promising medicine was announced this week and has boosted bond and stock markets. Both markets are pricing in a significant improvement of global economic growth in 2021.

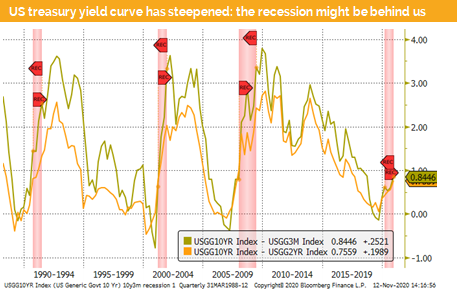

The US yield curve has steepened, and we expect that Q4 will show some modest growth. Providing it stays this way, we might have had no recession, as only one quarter (and not two in a row) would show a negative growth.

There is a lot of uncertainty not only around the pandemic, but also on the political side. China and Europe hope that they can significantly improve their relationship with the US once Biden takes over on the 2oth January 2021.

We expect that US senate will stay under control of the republicans and therefore, Biden administration will not fully implement their agenda. Nevertheless, we expect a fiscal package of USD 1.5 to 2.0 trn. If this stimulus reaches the real economy, we can expect that the US will grow more than 2.0% next year

In Europe the situation is different, and we must expect a double dip recession due to the 2nd partial lockdown. However, the impact on GDP is roughly 1/3 of the Q2 2020 effect. Europe will implement its way of fiscal stimulus in H1 2021 and the ECB has already announced that hey are willing to keep stimulating.

Currencies, Commodities, Equity & Bond Indices

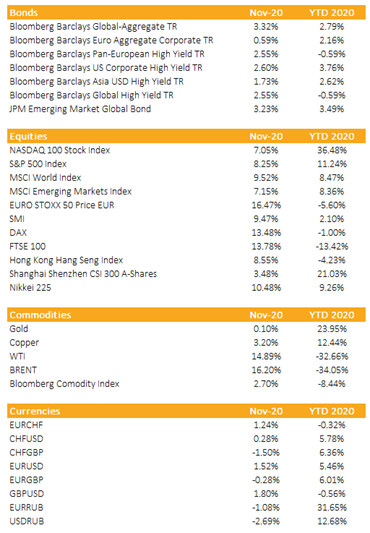

We have seen another sector rotation in the US from risky investments (US small and mid caps, US value shares and cyclicals) back into large cap tech.

But the real big move happened in the bond market. 10-year US treasury yields went up from around 75 bps to 97 bps and significantly underperformed corporate IG bonds.

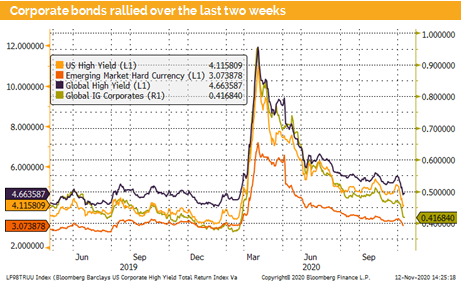

Global high yield bonds rallied hand in hand with global equities. The actual benchmark yields are at low levels. The US high yield benchmark offers a YTM of around 4.1% this is still significantly more compared to IG bonds with 0.41% . The TINA (there is no alternative) argument stays valid. US treasuries and IG corporates corrected for inflation offer negative real yields.

Central banks have been nudging the investors into risky assets. We expect this financial repression environment to last for a long period of time. The Fed has clearly indicated that their rate will remain at zero for more than two years and they will consider to raise interest rates only once the inflation gets higher than 2%. However, to reach that, we need to see the 5th US fiscal package.

Risk-on: There is light at the end of the tunnel

Liquidity

The CHF has appreciated during the pickup of the new corona cases in Europe. Since the announcement of the COVID-19 vaccine and the risk-on mode, we have seen a deprecation of the CHF against USD and EUR.

The EUR has lost value against the CHF. There was a range bound development against USD. We trade back at levels seen three weeks ago. We expect the EUR to strengthen further if the news flow from the vaccine front stays encouraging.

The USD has strengthened before the US election. Since then, we have seen a weakening driven by the expected 5th fiscal package and the Fed narrative

Equities

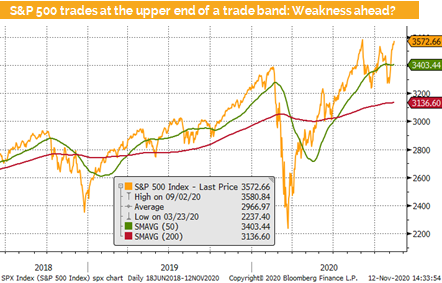

Equities were on a roller coaster during November. Markets have spiked around the US election day and especially after the announcement of Pfizer/BionTech’s effectivity of the COVID-19 vaccine, but we are now overbought. We expect a digestion phase before the year end rally.

US equities keep being a corner investment. However, due to an expected weakening of the USD, we believe emerging markets are offering interesting perspectives. Our focus lays on Asia.

Brazilian equities are still trading at very low levels, and the BRL has weakened since the beginning of the year. We might see a continuation of recent outperformance.

Fixed Income

The recent spike in US Government bond yields should mean revert. The Fed anchors the short end at zero for the foreseeable future and can influence the prices of treasuries with QE4ever .

Corporate bonds should as well mean revert. However, we believe, that considering all liquid alternatives, US denominated corporate bonds still offer value and we do not see reasons for a significant spread widening over the next weeks .

Alternative Investments

Gold: The recent sell-off was triggered by the risk-on mode after the announcement of a COVID-19 vaccine. US government bond yields have risen and short-term the USD has strengthened. Gold now trades below its 100-day average, and the chart looks vulnerable. Mid-term we expect the USD to weaken and gold to rise.

REITS: Risk-on mode moved commercial real estate sharply up. Meanwhile, residential REITS continue rising like the weeks before. We still prefer residential over commercial REITS. The risk-on mode might be short lived as Pfizer/BoinTech can only produce 1.5 trn vaccines next year and the distribution problem (the vaccine must be transported at minus 70 degrees) must be solved first. Therefore, we expect no significant easing of the COVID-19 restrictions before the end of H121.

Investments covered:

CIFI Holdings

Lenovo Group

SLM Corporation

Dell Inc

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate