Bi-Weekly. December 2020 I

OECD cuts global GDP outlook while leading indicators rise

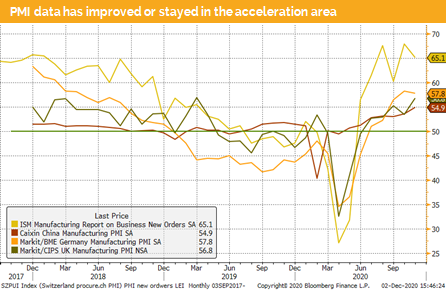

The OECD revised its global GDP forecast. Unsurprisingly, they cut their estimate from 5% to 4%. Meanwhile soft indicators, normally not considered by economists, have improved across the globe except for Europe.

China’s latest trade data reached an 18-year high and industrial production as well as consumption data has improved over the last weeks. It is quite likely that we will see China growing around 6% next year.

The key risk for further economic growth is the acceleration of global spread of COVID-19. Will it be like the 3rd wave of the Spanish flue? Can we avoid it? The hope for the positive impact of the vaccination is probably too high. There are still many open questions – starting from the capacity to produce the promised number of doses to the vaccine distribution challenges.

Meanwhile we depend on further fiscal stimulus. In the US a mini tax deal might be done before the year-end. The main purpose would be supporting unemployed citizens. The latest US job data was weak, but it was good news for the financial markets, as the expectation of a deal before the inauguration of the new US president has risen.

Meanwhile in Europe the rescue package and the normal budget for 2021 are stuck in the approval process due to the veto of Poland and Hungary.

The tedious EU/UK divorce discussion is still ongoing. Both parties don’t seem to be willing to give in, and an unorderly BREXIT is still on the cards. Both sides might get in a last-minute agreement to ensure that some orderly cross-border trades might still be possible in January until a solution is found.

Forecasts are always surrounded by uncertainties, but due to the pandemic we have a situation where markets and soft indicators are promising, while economists are starting to revise down their next year growth forecasts.

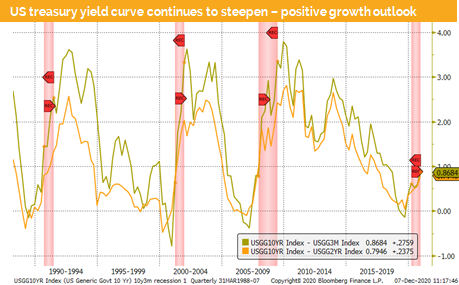

We stick to our soft economic indicators and stay constructive for 2021. Korea’s export statistics have improved, PMIs from China, US and most emerging markets are all indicating an acceleration of growth. The US yield curve has further steepened. If we get a lot of people vaccinated in H1 2021, growth should be higher than the latest OECD outlook.

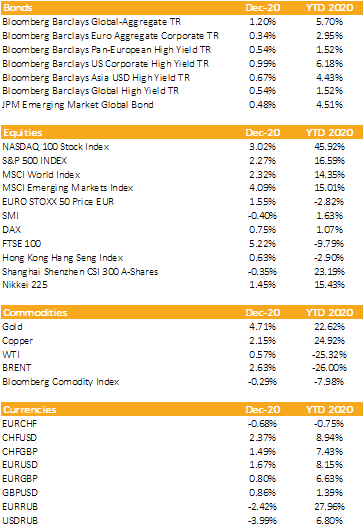

Market Overview: Currencies, Commodities, Equity & Bond Indices

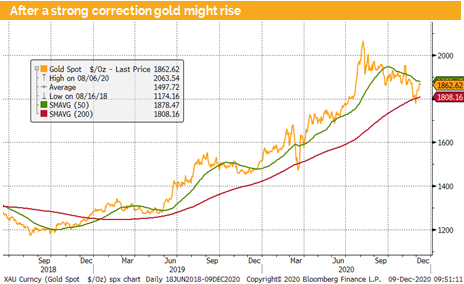

Gold sold-off during the last 4 weeks. Such drivers as positive announcements regarding COVID-19 vaccine stimulated the risk-on mode on the market and let corporate bonds and global equites to rise strongly.

The Russel 2000 index had its best November since 1987. But November 1987 was a partial reversal of the losses during the 1987 October crash. Nowadays the risk-on trade and the hope for a strong economic recovery enable US government bond yields rise sharply.

This risk-on mode was mirrored by a risk-off mode in the gold market. The price correction went below the 200-day average, which motivated all gold skeptics to call it the end game. Sor far the further sell off expected by gold bears did not materialized. On the contrary, we have seen a strong rebound.

We expect gold to perform well during the coming months and would not recommend to sell it.

All the key arguments for gold are still in place. Lower for longer, more stimulus and the intention to let inflation overshoot above 2% should support the gold price. Gold serves as a good investment to protect money from such risks.

Investment Outlook: Risk-on continues, markets are running ahead of themselves

Liquidity

The CHF has appreciated against the EUR while reaching 1.0860. One month ago, we were at 1.07. This week the ECB is going to announce further steps to support the economy, which might weaken the EUR.

The EUR/USD has broken through the 1.20 level and is now retesting this new support level. Given the strong move over the last weeks a mean reversion after the ECB meeting is quite likely.

The USD has further weakened. There are no USD bulls around, which indicates that many short the dollar. A mean reversion is in the cards.

Equities

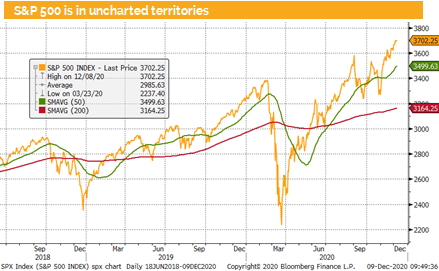

US equities have reached several new record levels. We are in uncharted territories. The air got definitively thinner and a short-term pullback would be healthy. However, bull-runs can last for some weeks and push markets to unreasonable levels. We do see some exuberance, but like older strategists we would repeat “markets can stay irrational much longer than you can stay solvent” (Keynes).

The hope for a mini fiscal package in the US has risen as both parties agree in principal that the unemployment benefit must be restarted. This, however, is already priced in, and we would not expect a tax deal to have a strong impact on equity markets.

Fixed Income

The US Government bond yield curve has steepened further. Market participants expect a strong economic recovery and higher inflation in 2021. While the former looks reasonable and is supported by a base effect due to weak H1 2020 figures, the latter is questionable. Apart from tax increases and the effect of a higher oil price it is hard to see where the price pressure should come from.

Corporate bonds have rallied, and we would expect that the main driver for the coming weeks will be earned interest and not further spread tightening.

Alternative Investments

Gold: The recent sell off was triggered by the risk-on mode after the announcement of three COVID-19 vaccines.

REITS: Risk-on mode moved both commercial and residential real estates sharply up. We still prefer residential over commercial REITS. The risk-on mode might be short lived as Pfizer/BoinTech has announced that they won’t be able to produce as many doses as promised in the short run. The logistic challenge is another issue which must be solved.

Oil: Risk-on let the oil futures rise sharply. We expect that the announced increase of production by the OPEC+ conference will soften a further price increase. However, most oil analysts expect that the price might go up another USD 10 per barrel.

Investments covered:

Calpine Corporation

Owl Rock Capitlal

B2W Companhia Digital

XPO Logistics

Pfizer Inc

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate