Blackfort Analytics – 2018. A Review

Global markets in 2018: Down but not out

-

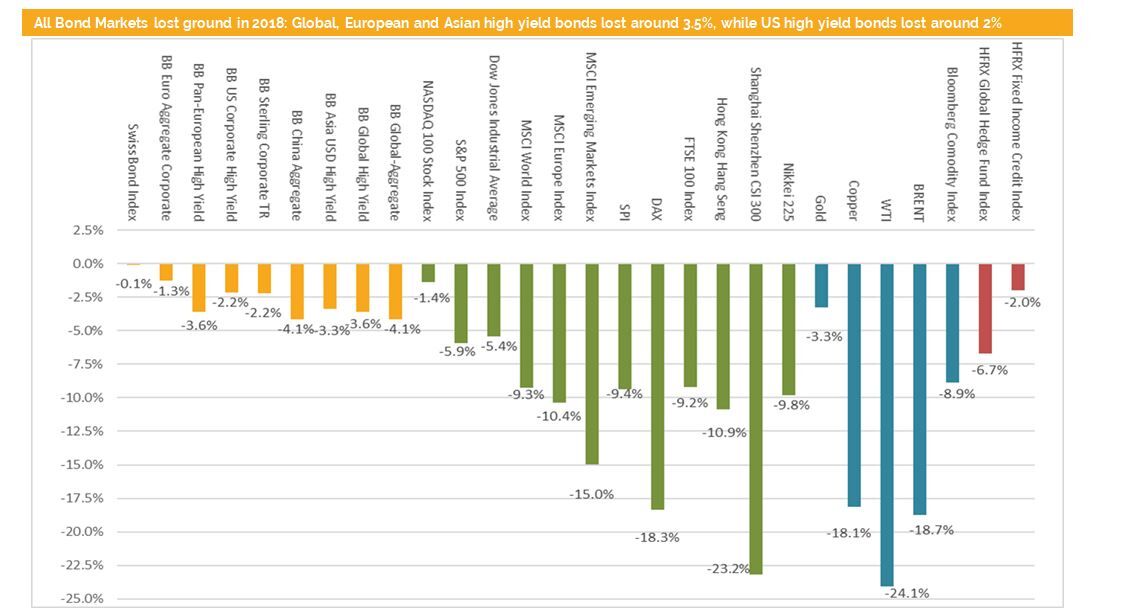

2018 was a year to remember. All major asset classes lost value!

-

Politics have dominated the markets. It started with country specific events in Brazil, Argentina and Turkey. It continued with global tariff conflicts and ended with fears about global growth in 2019 and with a further selloff in US equites and US high yield bonds after the FED rate hike communication.

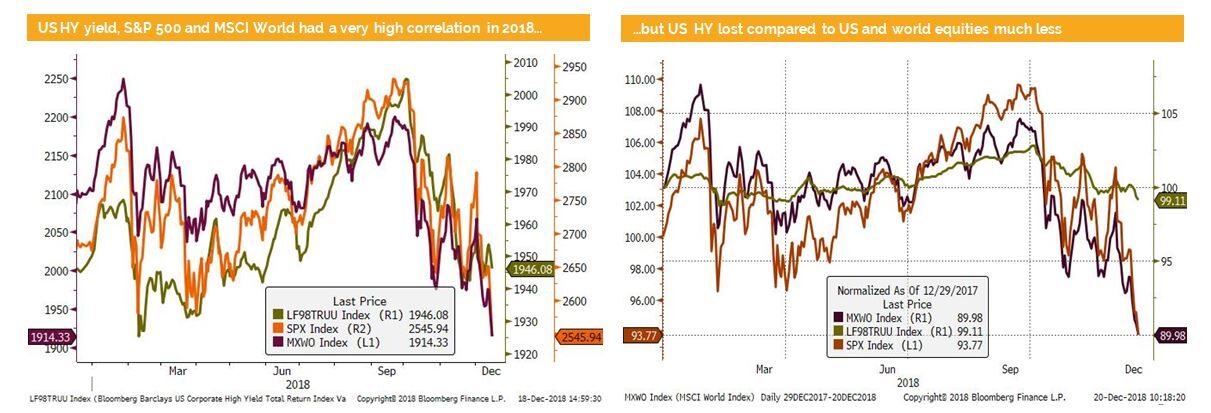

Corporate HY bonds moved in tandem with global equity markets

- Although the spread for US high yield bonds widened around 160 basis point since October the asset class is outperformed European and Asian high yield bonds.

- The FED announced that the pace for rate hikes will be lower in 2019. The market expects now 2 hikes in 2019 and one hike in 2020. Nevertheless the Fed didn’t announce that they will pause in H1 2019 and they are completely independent from politics. As a consequence US high yield bonds and US equities sold off during the fed press conference.

- Based on the latest softer economic data besides the FED we can expect that the ECB, the Bank of England and the Japanese central bank will restrain from hiking rates.

- China has already announced that they will stimulate the economy with fiscal and monetary measurements.

- We can therefore expect that the US 10-year yield will stay in a trading range around current levels. This is good news for dollar denominated corporate bonds. After the spread widening in US and in most other emerging markets hard currency bonds we see interesting yield levels and the opportunity for some capital gains in 2019.

- We prefer bonds with a 2-4 years maturity to partially protect portfolios. As both political and economical risks have risen we further recommend to invest in “BBB” bonds and have reduce partially our allocation in the “BB” bonds

- We expect that in H1 2019 equities will rebound and with it corporate bond spreads should slightly tighten. The most attractive area is Asia, followed by Brazil.

- We continue to look for opportunities in fallen angels, such as GE, Koc, Holding or Deutsche Bank etc. In all cases there were company specific events. These bonds traded at implied ratings which were in the single “B”- and “CCC”-area and were not reflecting properly the fundamental value of these companies.

A Slow down in 2019 – but still no recession

- US GDP will slow down to around 2-2.5% in 2019, which will most likely hinder the FED to hike rates more than twice.

- This forecasts is based on leading indicators and ISM PMI data. However, there are risks to the down side. For instance the bond market sends since months signals that the yield curve might invert and announces a recession. The 10y2y US government spread is at the moment at around 10 basis point. Although. the FED prefers to watch the 10Y3M spread which stands at around 35 basis point. Bottom-line we believe that the curve is distorted due to the recent selloff, the exaggerated recession fears and the drop in yield after the FED rate hike communication. We therefore agree with the FED and the IMF forecasts that the US will grow in 2019 at around 2.5% and will not fall into a recession.

- China’s government has announced that fiscal and monetary stimulus will be implemented in 2019 and therefore GDP might still slow down to 6% but a recession is definitively not expected. Last but not least Japan and Brazil will grow faster in 2019 compared to 2018. Having said that around 60% of the global economy will grow in 2019. Therefore a global recession is very unlikely.

- Even Europe, based on recent PMI data, which stayed just above 50 in the growth area, is still expect to grow modesty in 2019.

- Equity markets and oil markets have overreacted and priced in a recession. This should lead to a rebound in 2019 accompanied with high volatility.

- If our assessment regarding the global recession risk is correct we believe that corporate bonds offer now attractive yields for new investments. But we deploy our new investments mainly in the “BBB”-area with a short duration as the additional yield pick up in “BB” or single “B” bonds is not only too risky but also offers not enough return for the taken risk.

Disclaimer

These Market Business Reviews (further BR) are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate