Bi-Weekly. October 2020 II

Macro Update: The latest economic data from China and the USA shows surprise

The latest macro data release in China showed that Q3 GDP grew at 4.9% – a touch below the consensus. But the numbers from September show a strong acceleration in the consumer area. The industrial sector is already above the pre-COVID level. The number of new infected stays at very low levels.

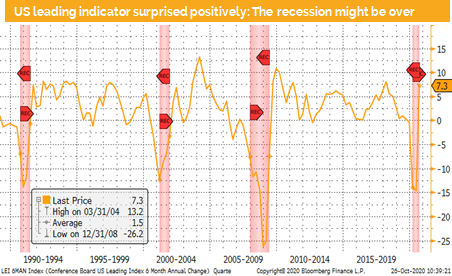

Meanwhile in the US consumer confidence and US conference board (leading indicators) were very strong disregarding the 3rd spike of COVID-19 in the US. The same picture is drawn by the US flash PMI data.

Europe on the other hand, is the new corona hotspot. Large economies like France, Spain and Italy have implemented partial lockdowns in combination with a curfew during the night for some industries. The main problem in all countries is the health system that can not handle the number of new hospitalizations. Roughly 1% of the new announced cases end up in hospitals.

What it means in the end is a slowdown of the already weak European economy. However, so far all countries try to avoid the 2nd complete lockdown. Given the exponential increase in new cases it makes it impossible to foresee the further economic development. It is the virus which dictates the next steps. That is what officials keep repeating. However, not following the precaution measurements might also accelerate the spreading of the virus.

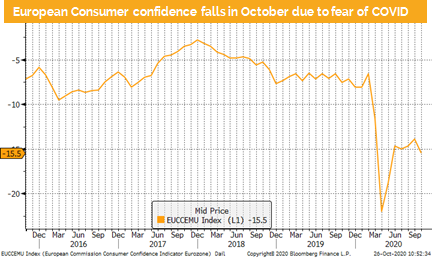

What we can see so far is that export-oriented economies like Germany or Switzerland profit from the strong rebound in Asia. Still, the latest Eurozone consumer confidence index or the German IFO indicator have started to roll over due to the fear of the 2nd lockdown.

No matter the winner of the US presidential election, both candidates have announced that they will continue with “America first” program. Similar statements were made by president Xi – the new 5-year economic plan concentrates on “China first”, which means the reduction of export dependency and boosting for domestic consumption and production.

A hard Brexit is back on the agenda, which would not only be extremely expensive for the UK, but would also negatively affect the Eurozone growth outlook.

In Europe first bonds were issued to finance the announced recuse plan. Roughly 1/3 of newly issued bonds went directly on the ECB balance sheet. The key question is how effective will these funds be allocated to the “rescue” Eurozone economy. The Spanish government has already announced to use the money for its normal budget, as the tax income has collapsed.

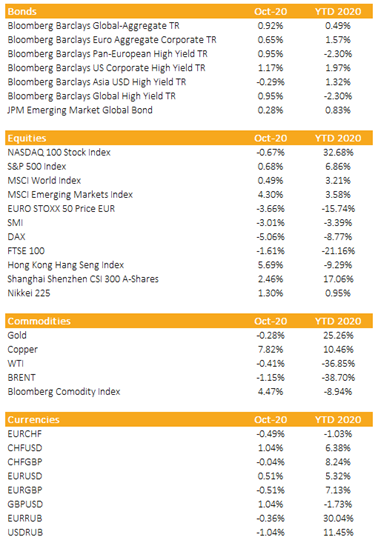

Market Overview: Currencies, Commodities, Equity & Bond Indices

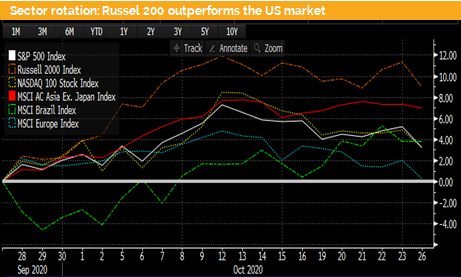

We have seen a sector rotation in the US. Large cap tech has underperformed US small and mid caps due to peak earnings in the tech sector and a solid domestic US recovery (according to the Fed’s “beige” book).

The US market is strongly affected by the US elections. If we have a clear winner after the 3rd of November, we can expect more fiscal stimulus and further rising markets. However, if we have a close outcome and either party does not accept the result, we must expect further probable short-lived downside.

Europe has underperformed again. The weak economic outlook and possible partial lockdowns are reflected not only in leading indicators but also in a weekly equity market.

The recovery of the Brazilian equity market since the beginning of October is remarkable.

Asian equities together with the US (our preferred investment classes) have advanced further during the last month.

Investment Outlook: Virus and US policy concerns hurt stocks and corporate bonds

Liquidity

The CHF has been depreciating against the USD for most of the month. But since some day we do see a deprecation against most currencies. It is quite likely that the SNB has intervened to strengthen appreciation during October.

The EUR has continued to strengthen against the USD. ECB members have started to verbally intervene against a strong EUR, although steering the currency price is not within their mandate.

The USD was range bound during October. The expected additional fiscal stimulus and the Fed comments on lower rates for longer time are both adding additional pressure on the USD. We expect the USD to weaken further.

Equities

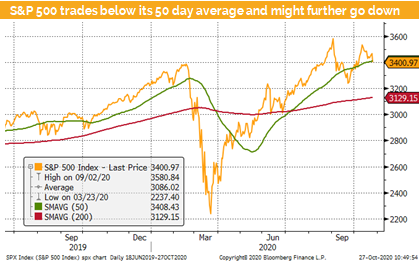

During October we have seen a roller coaster. Positive beginning was followed by a global drop in prices due to fear of the negative impact of a 2nd lockdown. We believe that if hospitals can handle the new infected people, we will only see local and partial lockdowns.

Some US states have even decided to avoid implementing further protection measures, ignoring the advice of the COVID-19 experts.

Short-term we expect markets to go further down before the elections, but once a new president is approved, we expect further growth. The expectation is viable as both candidates will push the next fiscal stimulus package through the parliament, and markets will price it in before the actual implementation in Q1 2021.

Fixed Income

Government bonds profit from the rising fear of new lockdowns due to the new COVID-19 wave. US high yields have fallen almost 1% on Monday when the announcement that the number of new infected people is being currently at the highest level ever.

Asian corporate bonds profit from the quiet situation at the COVID front. China, Japan and South Korea have almost no new cases due to strict testing, isolation of infected citizens and rigid quarantine rule for tourists.

Alternative Investments

Gold: Due to the higher US government bond yields and a strong USD gold continued to trade in a narrow price range. From a technical point we are now at levels where a breakout can happen any time soon. We stay invested in gold as risks are rising, and gold might partially hedge against drops in bond or equity markets.

Oil: Demand has not recovered, and further lockdown measurements are in the pipeline. Although we have seen a cut in production during Q2 and Q3, the supply of oil is still too high. The expected measurements against the spread of COVID-19 will have a negative impact on the demand for oil. We therefore do not expect a significant rise in oil price over the coming weeks.

Investments covered:

Logan 5.25% 2025

Millicom 4.5% 2031

Promigas 3.75% 2029

STLC 4.8% 2028

Tesla

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate