Bi-Weekly. March 2021 I

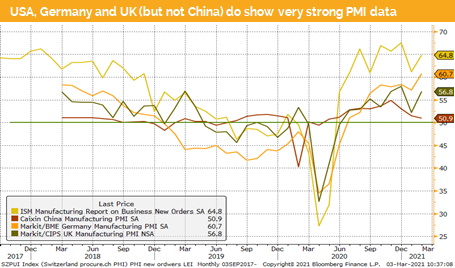

Macro Update: Very strong PMI data across the globe

New PMI data has been released. This time we got a real positive surprise. Export oriented countries like Germany, Taiwan or Switzerland were reporting figures around 60 (acceleration area). Netherlands, France and even Italy were above 55. Eurozone industrial PMI was reported just a touch below 58, which is surprising in the light of the ongoing lockdowns in most Eurozone countries. It shows that the production was adapted to the new situation and, in some cases, has already reached pre crisis levels.

The US ISM PMI was announced above 60, showing a strong economic outlook. This data was supported by the progressing approval of the 5th US fiscal package which will be around 7-9% of US GDP. The expected US GDP outlook was raised by Goldman Sachs to 7%. Some economists, like Larry Summers, former US treasury secretary, fear that the stimulus might push GDP above 8%. He repeatedly stressed that the fiscal package is too large.

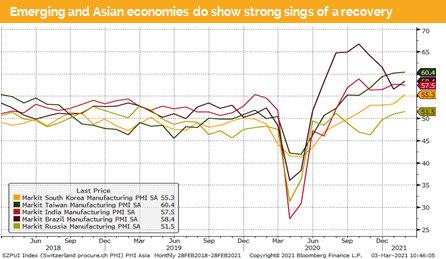

For the rest of the world the growth outlook, based on the latest PMI data, significantly improved. We do see very strong PMI figures in Brazil, India, Australia, South Korea and South Africa. The only exception is Mexico where the PMI stayed in the contraction area.

For once, China has found itself on the weaker side with PMI data bellow 51. The main reason might be the New Year holidays (11-17 of February). Since then, the business activity data, like container shipping, have picked up.

Japan, where the Nikkei reached a 30-year high, has reported a PMI in the growth area for the fist time since 2019, which confirms the strong rise in equities. Also, in Q4 2020 Japan has positively surprised with the release of very strong Q4 GDP figures.

Russia reports a PMI indicator in the growth area for the second time in a row. The country is profiting from a surge in demand for commodities.

Texas has announced the lift of almost all pandemic restrictions on economic activity. Texas will be a test case for how consumer spending patterns shift after the reopening of the economy. It is expected that we see a huge pent-up demand driven by consumers. The UBS chief economist expects that the boost in consumption will surprise all forecasters and the roaring twenties scenario might be the most likely outcome. We, therefore, would see euphoria in financial markets driven by massive and, so far, unexpected economic activities.

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

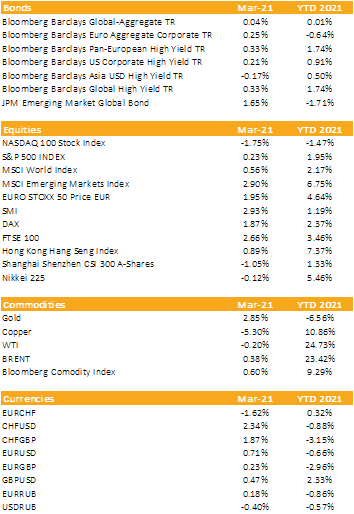

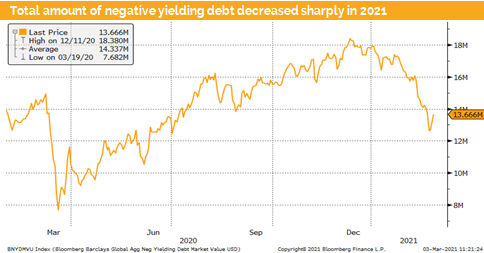

Market participants expressed disappointment with the Fed not reacting to their inflation fears and increased their selling volumes of treasuries. We have seen a sharp rise in US treasury yields after Fed’s chair Powell’s testimony in front of US parliaments and his downplaying of the inflation risk.

Globally government bonds in other currencies did move in tandem with their US counterpart. Markets were testing the Fed and other major central banks.

Break-even inflation derived from US TIPS (Treasury Inflation-Protected Security) have risen since the beginning of 2021 from around 1.6% to above 2.2%. This forced central bankers to verbally intervene, and to assure that they might adapt their bond buying program to dampen a further rise of longer maturing government bonds.

The Fed officials kept informing that the actual rise of inflation data is only a temporary phenomenon and will calm down by the end of 2021.

The Fed is targeting inflation measured by the US GDP PCE deflator factor. Measured by this inflation barometer bond markets have calmed down after the release of the latest figures at the end of February. The PCE stood at 1.5% right in the expected range, followed by a relief rally in government bonds and equities. The jury is still out if the Fed is right with its assessment of inflation or if we will see soon higher US government bond yields.

Investment Outlook: Climbing the wall of worry after the recent minor pullback

Liquidity

CHF has weakened against USD and EUR. The market is pricing in the reopening of the European and US economies. The safe heaven function of the CHF is less demanded right now.

EUR is range bound against the USD and has strengthened against CHF.

USD measured by the DXY index is rage bound like the EUR/USD as well. The expected weakening has paused. The anticipated US fiscal package should put additional pressure on the USD. However, the net positioning of market participants is at extreme levels on the short side.

Equities

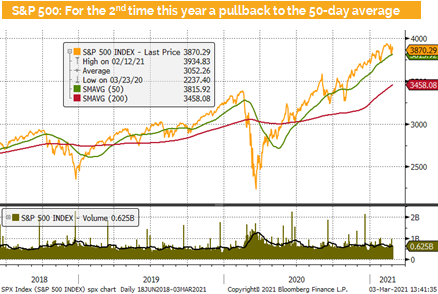

The expected pullback has taken place. However, the small size of the correction came as a surprise. At the end of February, we have seen a sell-off to the 50-day average followed by a strong bounce back just like at the end of January. Buy the dip due to fear of missing out (FOMO) is still the dominate behavior.

We expect that this pattern might repeat during 2021 until a real correction of more than 10%. But before that we most likely will see a further rise in global equity prices.

Fixed Income

vThe rise in US government yields has not significantly impacted the corporate bond markets so far. We did see a minor pullback in prices while at the same time spreads stayed stable. This is rather unusual, as globally the alternative investment opportunities to invest in government bonds get more attractive with higher yields.

We still consider the actual yield level of government bonds as too low to deploy our clients’ assets. We prefer corporates but at the same time must add that expected returns are at very low levels.

We continue to overweight corporates in the BB risk bucket. There, Asian corporates offer around 190 basis points higher yields compared to the US pendants while its benchmark duration is around 2 year shorter. The yield to worse in Asia is around 5.2% which compares to 3.3% for US BB corporates.

Alternative Investments

Gold: The price has dropped due to higher US yields, higher real US yields and the risk-on mode. We expect a test of the USD 1’700 level in the coming weeks. Mid-term we believe that physical gold will play out its protection role in portfolios.

REITs were on a roller coaster trip but are still trading higher than two weeks ago. We continue to prefer residential REITs but have seen recently a selective pickup in commercial REITS.

WTI and Brent futures have risen further until the equity pullback was mean-reverted. Since then both oil futures are range bound but the prices stayed for both WTI and Brent above USD 60 per barrel so far.

Investments covered:

Expedia Group

TTM Technologies

T-Mobile

Zoom Video Communications

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate