Bi-Weekly. February 2021 I

Macro Update: Solid macro indicators and strong Q4 data in the US and China

The strong Q4 macro data from China was followed by the positive indicators from the US. In Q4 US GDP grew by 4% and the economy decreased by 2.5% in 2020. This data was derived from the macro indicators and came as no surprise. However, we remember that in Q2 and Q3 2020 the IMF, the World Bank and the consensus estimates of economists where very bleak and might have surprised some of the forecasters as a result.

It is not unusual for economists to be late with revising data up or down, and normally, on average, the resilience of the economy is underestimated.

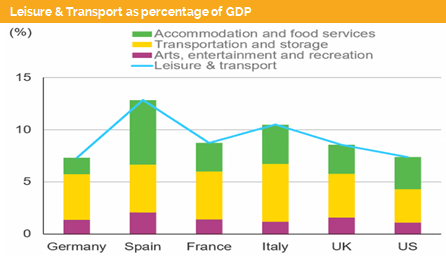

The production industry was able to adapt fast and to hold up production due to new COVID-19 regulations. Meanwhile, the service industry was hit harder, especially in areas like tourism, leisure and entertainment where we have seen a complete standstill. But it represents only around 7-15% of total GDP. Therefore, its impact on the whole economy is limited, and the data in China and the US confirms that in Q4 2020.

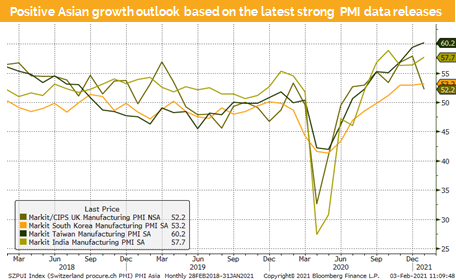

The core theme for 2021 is the reopening of the economy. We can see that the latest PMI data show slightly lower figures across the globe, but we continue to stay in the growth area.

The official PMI was almost unchanged in China, while the private data, which covers the small and mid-sized businesses (SME), was down from 53 to 51.5. This is still in the growth area, which starts at 50.

In the US the ISM PMI data was weaker but stayed in the acceleration area with 58.7. One reason for that is the hope for more fiscal stimulus. It looks like the new president and the republicans in the senate have agreed that the pending package will be bigger than expected by market participants, but also lower than the announced USD 1.9 trillion.

Meanwhile in Europe the PMI data was lower due to actual lockdowns, and apart from Spain all countries stayed in the growth area. This basically means that after the end of the double dip recession the expectation is that in Q2 and especially Q3 the Eurozone will show a fast and strong recovery.

The strongest PMI data were seen in Asia with India, South Korea, Taiwan and Australia leading the pack. Together with the good data from China we can expect strong growth in Asia, which should have a positive impact on financial markets.

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

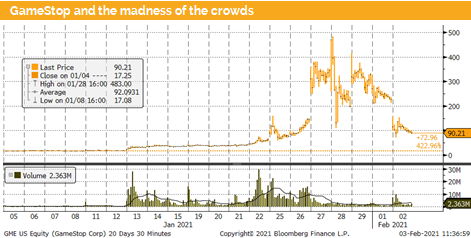

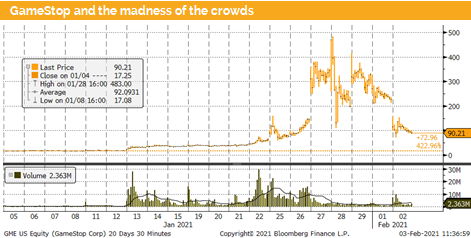

Reddit with its subforum r/wallstreetbets and Robinhood.com felt the spirit of occupying Wall street and pushed the price of GameStop up from USD 17 USD to USD 483. The sharp decline to USD 90 was around the corner. As a result, hedge fund which was short selling the stock came into trouble and was rescued by other hedge funds. At least that’s the official story.

Rumors are that some other hedge funds went long before the Reddit forum was infiltered with the news about GameStop. It might be the case, but we will never find out. What we can say is that the last holders of the stock, i. e. retail investors will pay the price. The stock dropped in two days from USD 400 to USD 90 and it probably will go further down.

Meanwhile the “wallstreetbetters” went on to speculate in silver. However, this market is much bigger, and it takes more buying pressure to substantially move the price of silver. Short-term the price went up from around USD 26 to USD 30, but as we speak it is back to USD 26.

We should probably learn to live with more of such market interventions from the investment forums, but in the situation with GameStop the probability, that based on such actions retail investors will get rich, is very unlikely. On the contrary, they might learn expensive lessons as a group.

Investment Outlook: The expected equity market pullback was short-lived

Liquidity

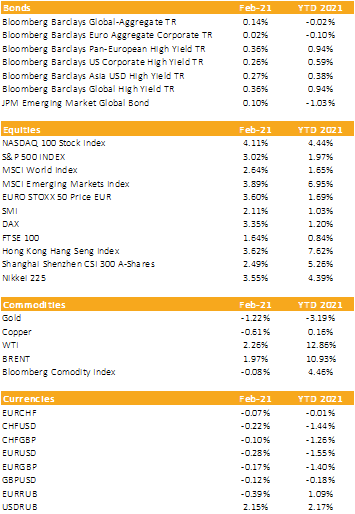

CHF has weakened against EUR and USD. The Swiss National Bank has agreed to distribute more of its market profits, which might have put some pressure on CHF.

EUR has further weakened against the USD but continues to stay above 1.20. This was rather a USD strength than EUR weakness.

USD has been strengthening. Historically USD is usually weak before the inauguration but after the president is in power it gets stronger and finally mean reverts. As a result, consensus trade is to be short, but we expect a further weakening only in mid-term.

Equities

Global equity markets corrected during the last week of January, pushing most developed market indices into the red. The selloff was mild and happened with low volumes. Meanwhile, most markets have regained most of these losses.

Asian markets were less affected and are outperforming US and European markets for the year.

The best performing market since the beginning of December was the Russel 2000. Also, cyclical stocks (mainly small and mid caps) are outperforming their local benchmarks globally.

Fixed Income

US government yields have continued to rise over the whole maturity spectrum. However, the yield curve has further steepened, which supports our positive outlook for the US economy.

The total amount of negative yielding debt has decreased from around USD 18 trillion to around USD 16.3 trillion since the beginning of the year. For all these affected markets the total return was therefore negative.

On the other hand, corporate non-investment grade bonds continued to perform well due to further spread tightening. We continue to prefer the non-investment grade area, as the yield to maturity in IG bond benchmarks stayed below 0.35% for USD bonds

Alternative Investments

Gold: The price of gold is trapped in a trading range around its 200-day average. We continue to believe that Gold will deliver protection against expected market turbulences and would not sell it even upon depreciation.

REITS: Both commercial and residential REITs traded in line with equity markets and are now as a group on average up for the year. We still see more downside protection in residential REITS.

Oil: WTI oil futures have risen further to around USD 56 USD. The main reasons are the OPEC+ countries following the agreed production cut and expected increase of demand during 2021 once the economies reopen.

Investments covered:

Ashtead Group

HollyFrontier Corp

Sovcombank

Visa Inc

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate